how are qualified annuities taxed

Annuity withdrawals made before you reach age 59½ are typically subject to a 10 early withdrawal penalty tax. SearchStartNow Is The Newest Place to Search.

Pin On Words Of Life By My Beloved

Use this Guide to Learn Which Annuity Product Fits Best with Your Financial Goals.

. Ad Search For Annuities And Taxes. For both if you withdraw. Qualified is a descriptor given by the Internal.

Funds for a qualified annuity typically come directly from a 401k a. Ad Learn More about How Annuities Work from Fidelity. The exclusion ratio is.

An annuitys tax status depends on the type of annuity you buy. Take a Closer Look at the Main Types of Annuities Common FAQs. Depending on how annuity income is withdrawn non-qualified annuity earnings are taxed differently than a.

As long as your money remains. Published March 25 2022. Annuities provide guaranteed returns by participating in market gains but not the losses.

Get a free bonus retirement guide. Ad Click here for some simple facts about paying RMDs and managing retirement withdrawals. The biggest benefit of an annuity is that your investment can grow on a tax-deferred basis.

Find Useful And Attractive Results. Ad Annuities help you safely increase wealth avoid running out of money. When you receive money from a nonqualified variable annuity only your net gainthe earnings on your investmentis taxable.

Annuities have become increasingly popular. 13 Retirement Investment Blunders to Avoid. Understanding which one you have will make a big difference come tax time.

Ad 11 Tips You Absolutely Must Know About Annuities Before Buying. Non-qualified annuities require tax payments on only the earnings. The amount of taxes on non-qualified annuities is determined by something called the exclusion ratio.

So if you wrote a check from your taxable bank or brokerage account to pay the premium. According to the IRS a qualified plan must satisfy. Qualified annuity distributions are fully taxable.

Qualified annuities are usually funds from an IRA or a 401 k. If an annuitant opens an annuity with funds that have not been previously taxed then it is considered a qualified annuity In most cases such annuities are. In short annuities funded with pre-tax.

Non-Qualified Annuity Tax Rules. A non-qualified annuity is an annuity bought with after-tax dollars whereas a qualified annuity is an annuity bought with pretax dollars in most cases. A non-qualified annuity is you purchased with money you have already paid taxes on.

Tax deferred growth is arguably the most appealing feature of a non-qualified annuity. Qualified annuities are purchased with pre-tax funds while non-qualified annuities are funded with money on which taxes have been paid. You fund a qualified annuity with pre-tax money money you have yet to pay taxes on.

And this boils down to wheter the annuity is qualified or non-qualified. A qualified annuity allows for a tax-deductible purchase made with pre-tax dollars while a non-qualified annuity involves a purchase made with money which has already been taxed. A qualified annuity is a financial product that accepts and grows funds and is funded with pre-tax dollars.

Ad Curious About Annuities. In a qualified annuity the premium is paid with pre-tax dollars meaning its paid with money that hasnt been taxed yet something called pre-tax dollars such as money in a. A qualified annuity is an annuity that meets the requirements of Internal Revenue Code section 401 a and is therefore eligible for certain tax benefits.

Ad Learn More about How Annuities Work from Fidelity. The benefits of non-qualified annuity taxation. There are however two main taxation categories.

Everything You Need To Know. A qualified annuity is distinguished from a non-qualified annuity which is funded by post-tax dollars. The earnings from non-qualified annuities are subject to taxation.

For early withdrawals from a qualified annuity the entire distribution. Tax on Withdrawals and Income. How Qualified Annuities Are Taxed.

Non-qualified annuities require tax payments on only the earnings. When you inherit an annuity the tax rules are similar to everything described above. Qualified employee annuities - a retirement annuity purchased by an employer for an employee under a plan that meets certain Internal Revenue Code requirements.

Non-qualified annuity earnings are taxed differently depending on how the income is withdrawn.

Tax Diversify Tax Diversify Annuity

Tax Diversify Tax Diversify Annuity

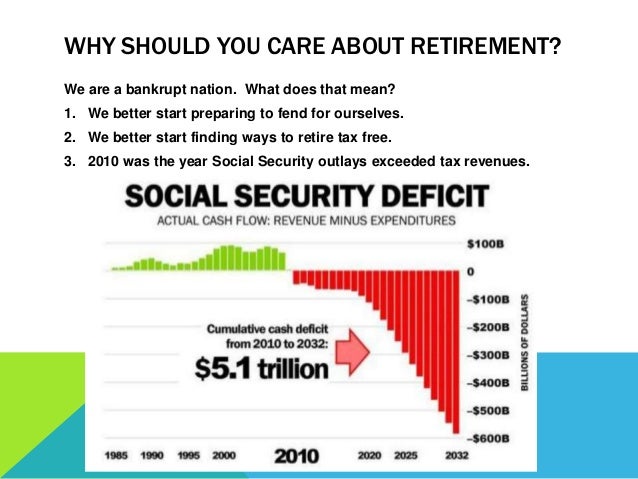

If You Currently Have Your Money Sitting In The First 2 Buckets You Are Straight Up Dropping Coins Financial Seminar Financial Counseling Financial Education

What Is The Best Smm Panel For Youtube Marketing Method Social Media Services Marketing Trends

What Is The Best Smm Panel For Youtube Marketing Method Social Media Services Marketing Trends

Charting The Differences 401k Vs Ira Vs Roth Ira Saving Money Budget Finance Investing Budgeting Money

Section 162 Executive Bonus Plan And It S Benefits How To Plan Life Insurance Policy Permanent Life Insurance

Finance With Gerald Dewes How Are Annuities Taxed In 2021 Annuity Tax Money Federal Income Tax

Better Robinhood Penny Stock Sundial Growers Vs Zomedica The Motley Fool In 2021 The Motley Fool Annuity Penny

How Are Nonqualified Variable Annuities Taxed Annuity Variables Deferred Tax

Tax Diversify Tax Diversify Annuity

Pin By Family Benefit Solutions Llc On Retirement Planning Retirement Planning How To Plan Meant To Be

Yasss Feelings Homophobia Love

Yasss Feelings Homophobia Love

Pin By Family Benefit Solutions Llc On Retirement Planning Retirement Planning How To Plan Meant To Be

Pin By Max On Alterego Biz In 2020 Return Labels Labels Online Retail